Security filings for global customs have complex issues to report declaration directly to customs.

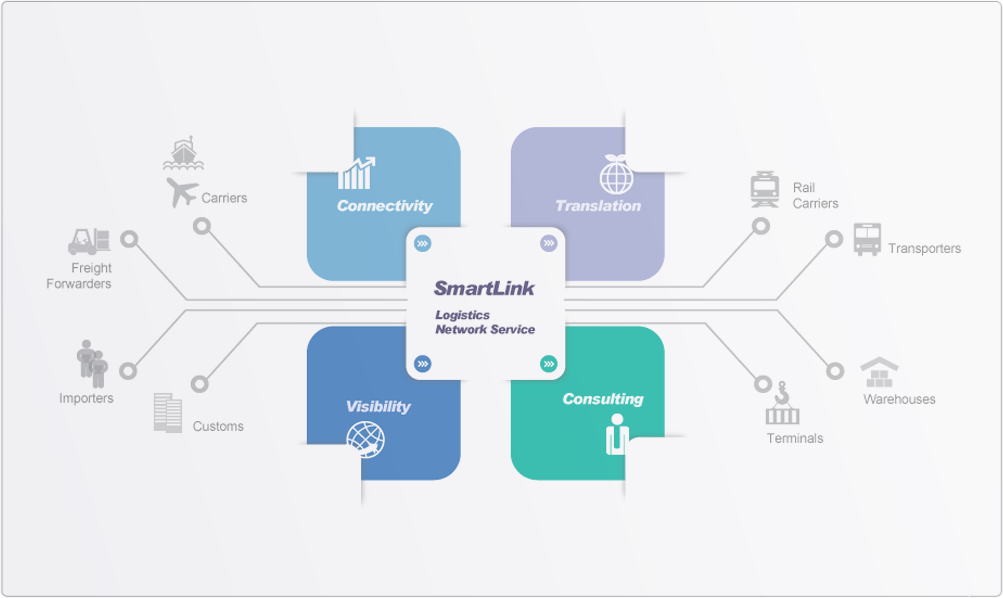

As one of the first service providers certified by global customs, SmartLink helps customers to solve their problems regarding customs declaration through

the global customs network, electronic data interchange, and featured visibility Portal of One-Stop customs declaration functions.

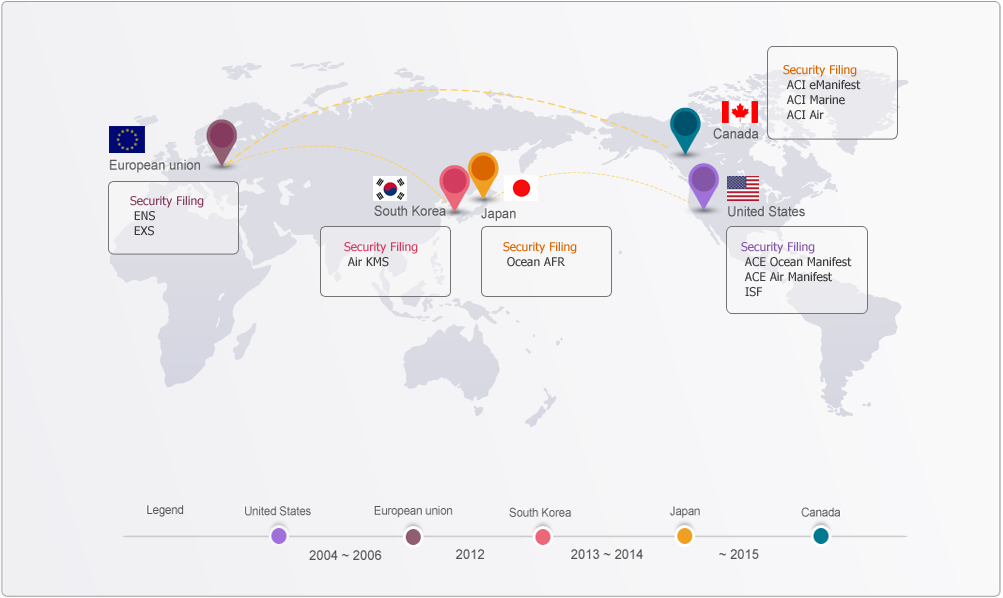

Tapped into at least 15 years of global customs services, and we're equipped with the skill set and ability to handle advanced filing services for most of the global customs authorities as follows:

SmartLink customs service provides Freight Forwarders, Carriers and Importers with a declaration solution that includes:

| Country |

Customs Rule |

Category |

Customer Type

(Filer) |

| U.S.A. |

ACE |

Ocean Manifest |

Ocean Carrier

Freight Forwarder |

|

(Automated Commercial Environment) |

Air Manifest |

Air Carrier |

| ISF (Import Security Filing) |

Ocean Carrier

Importer

Freight Forwarder(representative) |

| Canada |

ACI

(Advance Commercial Information) |

ACI Marine |

Ocean Carrier

Freight Forwarder |

| ACI Air |

Air Carrier |

eManifest

for Freight Forwarder |

Freight Forwarder |

| Japan |

AFR

(Advance Filing Rules) |

Ocean Manifest |

Ocean Carrier

Freight Forwarder |

| Korea |

KMS (Korea Manifest System) |

Air Import |

Freight Forwarder |

| Europe |

ENS (Entry Summary Declaration) |

ENS Marine / Air |

Ocean Carrier

Air Carrier |

| EXS (Exit Summary Declaration) |

EXS Marine / Air |

Ocean Carrier

Air Carrier |

Customs Regulations & Rules

U . S . ACE

1. The Latest Trend in US Customs Clearance after September 11 Attacks

In response to the disasters caused by the synchronized terrorist attacks on September 11, 2001, the United States has introduced a variety of enhanced security measures. They are being implemented in two major directions: administrative reorganization and amendment as well as supplementation of existing institutions.

The former pivots on the creation of the Department of Homeland Security (DHS), and with the administrative reorganization, adoption of new security measures is gaining speed. And the latter is what US Customs and Border Protection (CBP) implements by coming up with measures to stop maritime terrorism by creating a container security program that systematically screens trade goods arriving in the US, with a view to upgrading security for cargoes imported to the country and their route. Crucial elements of the latter are set up around Container Security Initiative (CSI) and 24-Hour Advance Vessel Manifest Rule (commonly called 24-Hour rule).

2. Background of 24-Hour Advance Vessel Manifest Rule

September 11 attacks posed serious problems as to the maritime container cargo transport, in that if international terrorists with intent to mount terror attacks bring into the US weapons of mass destruction (WMD) or nuclear weapons cached in a container ship, the damage should be tremendous. In fact, after September 11 attacks, experts estimate that ships are quite likely to become the next target for terrorists. As a matter of fact, container ships engaged in import and export operations go through ports in a number of countries and carry a great variety of cargoes and thus, run the risk of loading terror-related merchandise. That is why it has become imperative that they come up with a more secure system to stop international terrorists from taking advantage of maritime containers to commit acts of terrorism.

3. Key Specifics of 24-Hour Advance Vessel Manifest Rule

(1) Submitter of 24-Hour Advance Vessel Manifest

Parties that are directly involved in the implementation of 24-Hour Advance Vessel Manifest Rule include not only transporters (shipping companies) but also Non-Vessel Operating Common Carriers (NVOCCs) that use transportation service. Accordingly, 24 hours prior to loading at foreign ports, all transporters that want their cargo-carrying ships to call at US ports must submit a vessel manifest to the US Customs and Border Protection (CBP), using CBP Form 1302 or an electronic form that has been approved by CBP as the same. Moved up from the previous deadline set by CBP, which was 48 hours before arrival to a US port, the new regulation is designed to ensure a cargo security check.

Besides shipping companies, NVOCCs that deliver goods to shipping companies for loading from foreign ports must get a license from the Federal Maritime Commission (FMC) or, if in possession of International Carrier Bond, must electronically submit a vessel manifest to CBP through Automated Manifest System (AMS) 24 hours ahead of loading from a foreign port.

(2) Specifics of Declaration in 24-Hour Advance Vessel Manifest

As shown in Table 1, transporters or NVOCCs must submit information on cargo, container, and ship classified in total 14 categories.

Table 1

| < Table 1 > Specifics of Declaration in 24-Hour Advance Vessel Manifest |

| Cargo information |

●Ship’s (or transporter’s) B/L number and quantity.

●Accurate description (with 6-digit HS code) and weight of freight, or for sealed containers, shipper-provided description and weight

(however, such generic description as “freight all kinds (FAK)”, “general cargo”, and “said to contain (STC)” are not acceptable).

●B/L-listed shipper’s full name and address or identification number assigned by CBP.

●B/L-listed consignee’s full name and address, owner’s representative’s name and address, or identification number assigned by CBP.

●Internationally recognized hazardous substances code. |

| Container information |

●Container number.

●The seal number attached to the container |

| Ship information |

●The last port which a US-bound ship departs from.

●Standard Carrier Alpha Code (SCAC).

● Carrier assigned voyage number.

● Scheduled date of arrival to the first port of call in the US.

● Name of the port where a US-bound foreign transporter receives cargo.

● Ship name (its IMO number), name of the country where documents are created, and ship’s official number.

● Name of the foreign port where freight has been loaded. |

(3) Exceptions to 24-Hour Advance Vessel Manifest

A transporter etc. that specializes in carrying bulk cargoes such as oil, grains, and iron ore, or break bulk cargo (not loaded into containers, but packaged or bundled up) must submit a cargo declaration to US CBP 24 hours prior to its arrival in a US port.

(4) Sanctions for Violations of 24-Hour Advance Vessel Manifest Rule

In customs clearance, strict compliance with 24-Hour Rule is essential to securing the global supply chain from the perspective of US CBP. Therefore, against violations of 24-Hour Rule, US CBP imposes sanctions such as refusal to receive a vessel manifest, levying a fine, sending a message banning loading, refusal to offload containers, and detaining or confiscating a ship.

a. Refusal to receive a vessel manifest

With this measure, US Customs and Border Protection demands detailed and accurate provision of 15 items on top of the existing requirements for a vessel manifest. Therefore, when a transporter or an NVOCC fails to comply with the requirement for cargo declaration, US CBP may refuse to receive a vessel manifest. With regard to providing detailed and accurate information for a vessel manifest, phrases expressing ignorance or lack of knowledge such as “shipper’s load and count”, “said to contain”, “container sealed by shipper”, and “contents unknown”, or vague expressions such as “general cargo” are not going to be accepted. It is not acceptable to leave the ‘Consignee’ unnamed, simply state “As directed” or “As directed by shipper” in ‘Consignee’ or ‘Person to be notified’ without providing specific relevant information, write in a consignee name only without an address, or provide an incomplete or invalid address.

b. Levying a fine

A fine is to be imposed on a transporter or an NVOCC that is late in submitting a vessel manifest. To be specific, in case a transporter or an NVOCC fails to submit a vessel manifest in accordance with the rule, fails to declare in the manner specified in the rule, fails to declare within the required time limit, or electronically transmits to US CBP counterfeited, doctored, or false documents, vessel manifest, or data, a transporter is fined USD 5,000 for the first violation and USD 10,000 for each following violation while an NVOCC is charged USD 5,000 for later settlement and USD 5,000 for each next violation.

c. Sending a message banning loading and refusal to discharge containers

To a transporter or an NVOCC that has violated the 24-Hour Rule with incompletely filed cargo, US CBP delivers a message banning loading (‘Do Not Load’). This loading-banning message means that CBP has prohibited a shipping company from loading on a ship from an overseas port heading to the US a specific container found in violation of the 24-Hour Rule with an invalid or incomplete vessel manifest, or with regard to requirement related to consignee name or address. A transporter or an NVOCC that ignores a loading-banning message and goes ahead to load a specific container will be denied permission to discharge the container at the US port where the ship will arrive.

d. Detaining or confiscating a ship

When it fails to receive complete cargo information through a specified vessel manifest from a transporter or an NVOCC no later than 24 hours to the loading of cargo at a foreign port, the US CBP may prohibit offloading of the entire cargo until all required information is received, and may detain or confiscate a ship if it is loaded with weapons of mass destruction etc.

Thus, we have surveyed the background of and key details of 24-Hour Advance Vessel Manifest, which was fully enforced in the US from February 2003. In our next issue, we will take a bit closer look at the key specifics of Importer Security Filing and additional carrier requirements.

U . S . ISF

1. 10+2 Rule

On January 26, 2009, the new rule titled Importer Security Filing and Additional Carrier Requirements (commonly known as “10+2”) went into effect. This new rule applies to import cargo arriving to the United States by vessel. Failure to comply with the new rule could ultimately result in monetary penalties, increased inspections, and delay of cargo. The information submitted in Importer Security Filing improves the ability of the U.S. Customs and Border Protection (CBP) to identify high-risk shipments with a view to preventing smuggling and ensuring cargo safety and security.

Under the 10+2 rule, before merchandise arriving by vessel can be imported into the United States, the “Importer Security Filing (ISF) Importer,” or their agent (e.g., licensed customs broker), must electronically submit certain advance cargo information to CBP in the form of an Importer Security Filing, which consists of as many as 10 importer data elements (the “10” part of the 10+2 rule). This requirement only applies to cargo arriving in the United States by ocean vessel; it does not apply to cargo arriving by other modes of transportation. And the 10+2 rule states that carriers must submit Additional Carrier Requirements, which consists of vessel stow plans and container status messages (the “2” part of the 10+2 rule).

2. Importer Security Filing (ISF)

(1) Who is Responsible for the Filing?

The ISF Importer is required to submit the Importer Security Filing. The ISF Importer is the party causing the goods to arrive within the limits of a port in the United States by vessel. Typically, the ISF Importer is the goods’ owner, purchaser, consignee, or agent such as a licensed customs broker. For foreign cargo remaining on board (FROB), however, the ISF Importer is the carrier. For immediate exportation (IE) and transportation and exportation (T&E) in-bond shipments, and goods to be delivered to a foreign trade zone (FTZ), the ISF Importer is the party filing the IE, T&E, or FTZ documentation.

(2) What Must Be Filed?

a. Shipments Consisting of Goods Intended to be Entered into the United States and Goods Intended to be Delivered to a Foreign Trade Zone

ISF Importers, or their agent, must provide eight data elements, no later than 24 hours before the cargo is laden aboard a vessel destined to the United States. Those data elements include:

① Seller name and address ? last named overseas seller/address on the transaction invoice/purchase order.

② Buyer name and address ? last named buyer and address 24 hours prior to foreign lading.

③ Importer of Record Number ? unique identifying number of the entity primarily responsible for the payment of any duties on the merchandise or an authorized agent acting on his behalf. The unique identifying number can be the IRS, EIN, SSN or CBP-assigned number.

④ Consignee Number ? unique identifying number of the entity to which the goods are to be consigned. Typically, the consignee is the “deliver to” party at the end of the supply chain who has a fiduciary interest in the cargo. The unique identifying number can be the IRS, EIN, SSN or CBP-assigned number.

⑤ Manufacturer name and address ? name and address of the entity that last manufactures, produces or grows the imported commodity.

⑥ Ship to name and address ? named party and the address on the transaction that will physically receive the merchandise, which may be different from the consignee.

⑦ Country of Origin ? country in which the goods are wholly obtained or produced.

⑧ HTSUS number (six-digit level) ? the initial classification required of a shipment prior to entry being filed

And two additional data elements must be submitted as early as possible, but no later than 24 hours prior to the ship’s arrival at a U.S. port. These data elements are:

⑨ Container Stuffing Location ? Physical Foreign Location (street, city, country) where the goods are stuffed into the container prior to its closing.

⑩ Consolidator name and address ? Foreign Party that physically stuffs the container prior to its receipt by the carrier for shipment to the U.S. The consolidator’s address identifies the physical location of the cargo, which may differ from the usual manufacturer or shipper premises.

b. FROB, IE Shipments, and T&E Shipments

For shipments consisting entirely of FROB and shipments consisting entirely of goods intended to be transported in-bond as an IE or T&E, the Importer Security Filing must consist of five elements. Importer Security Filing for IE and T&E shipments must be submitted no later than 24 hours before the cargo is laden aboard a vessel destined to the United States and Importer Security Filing for FROB must be submitted any time prior to lading. The following five data elements must be submitted for FROB, IE and T&E shipments: ~ of FROB and IE, T&E shipments in < Table 1>

< Table 1> Importer Security Filing

SHIPMENT

TYPE |

GOODS TO BE ENTERED INTO

THE UNITED STATES |

FROB |

IE, T&E SHIPMENTS |

GOODS TO BE DELIVERED TO AN FTZ |

| Who |

No later than 24 hours before the cargo is laden aboard a vessel destined to the United States |

Any time prior to lading |

No later than 24 hours before the cargo is laden aboard a vessel destined to the United States |

No later than 24 hours before the cargo is laden aboard a vessel destined to the United States |

| When |

No later than 24 hours before the cargo is laden aboard a vessel destined to the United States |

Any time prior to lading |

No later than 24 hours before the cargo is laden aboard a vessel destined to the United States |

No later than 24 hours before the cargo is laden aboard a vessel destined to the United States |

| What |

* Ten data elements

① Seller

② Buyer

③ Importer of record number / FTZ applicant identification number

④ Consignee number(s)

⑤ Manufacturer (or supplier)

⑥ Ship to party

⑦ Country of origin

⑧ Commodity HTSUS number

⑨ Container stuffing location

⑩ Consolidator FROB, IE Shipments, and T&E Shipments

| * Five data elements

① Booking party

② Foreign port of unlading

③ Place of delivery

④ Ship to party

⑤ Commodity HTSUS number

|

* Five data elements

① Booking party

② Foreign port of unlading

③ Place of delivery

④ Ship to party

⑤ Commodity HTSUS number

|

* Ten data elements

① Seller

② Buyer

③ Importer of record number / FTZ applicant identification number

④ Consignee number(s)

⑤ Manufacturer (or supplier)

⑥ Ship to party

⑦ Country of origin

⑧ Commodity HTSUS number

⑨ Container stuffing location

⑩ Consolidator FROB, IE Shipments, and T&E Shipments |

3. Additional Carrier Requirements

In addition to submitting the cargo manifest information electronically to the CBP by way of its AMSs, the carrier is now required to electronically submit two additional data elements; a Vessel Stow Plan and Container Status Messages to the CBP for all containerized ocean vessel shipments inbound to the United States.

(1) Vessel Stow Plan

A Vessel Stow Plan must include information on the physical location of the cargo, in particular, dangerous goods and other high-risk containerized cargo, loaded onboard the vessel destined for the United States. The CBP must receive the vessel stow plan no later than 48 hours after the carrier departs from its last foreign port. If the voyage is less than 48 hours, the CBP must receive the vessel stow plan prior to the vessel’s arrival at its first U.S. port. The vessel stow plan must include standard information regarding the vessel and each container onboard the vessel. According to the CBP, the vessel operating carrier, not the NVOCC, is responsible for filing the vessel stow plan. For bulk and break-bulk carriers shipping part container cargo, the CBP requires the carrier to submit a vessel stow plan for all containerized cargo aboard the vessel.

(2) Container Status Messages

Container Status Messages (CSM) report container movements and changes in status, e.g., whether full or empty. If a carrier is currently creating or collects CSMs in an equipment tracking system, that carrier must submit CSMs to the CBP regarding certain events relating to all containers destined to arrive at a U.S. port by vessel. Carriers must submit CSMs electronically via the secure file transfer protocol no later than 24 hours after the message is entered into the carrier’s equipment tracking system. As with the Vessel Stow Plan, the CBP requires the vessel carrier, not the NVOCC, to submit CSMs.

< Table 2> Additional Carrier Requirements

| REQUIREMENTS |

VESSEL STOW PLAN |

CONTAINER STATUS MESSAGES |

| When |

No later than 48 hours after the departure of the vessel from the last foreign port, or prior to arrival at the first U.S. port for voyages less than 48 hours in duration. |

If any of the required events occurs, when the carrier creates or collects a CSM in its equipment tracking system reporting that event. |

| What |

* Information regarding the Vessel

① Vessel Name & IMO Number

② Vessel Operator

③ Voyage Number

* Information regarding Each Container

① Container Operator

② Equipment Number

③ Size and Type

④ Stow Position

⑤ Hazmat-UN Code

⑥ Load port

⑦ Discharge port |

① Equipment Number

② Event Description, Date, Time and Location

③ Vessel |

4. Enforcement

If the ISF is not filed, cargo will not move and in addition, CBP may issue liquidated damages of $5,000 per violation for the submission of an inaccurate, incomplete or untimely filing. If goods for which an ISF has not been filed arrive in the U.S., CBP may withhold the release or transfer of the cargo; CBP may refuse to grant a permit to unlade for the merchandise; and if such cargo is unladen without permission, it may be subject to seizure. Additionally, noncompliant cargo could be subjected to “Do Not Load” orders (DNLs) at origin or further inspection on arrival.

5. More Information

For more detailed information about the Importer Security Filing, visit the CBP website at

http://www.cbp.gov/border-security/ports-entry/cargo-security/importer-security-filing-102.

The website includes fact sheets, FAQs, and other public outreach sources. Additionally, questions may be sent to Security_Filing_General@cbp.dhs.gov.

Canada ACI

1. Overviews

The ACI program is about providing CBSA (Canada Border Services Agency) officers with electronic pre-arrival information so that they are equipped with the right information at the right time to identify health, safety and security threats related to commercial goods before the goods arrive in Canada.

2. Background

In 2000, then-Minister of National Revenue Martin Cauchon introduced the objectives that would lead to ACI as part of the Customs Action Plan. After the September 11, 2001 attacks against the United States, the security benefits associated with the project took on new importance. In the Canada-US Smart Border Declaration created in December of that year, then-Foreign Affairs Minister John Manley and United States Secretary of Homeland Security Tom Ridge called for “a system to collaborate in identifying high risk goods while expediting the flow of low risk goods.”

The idea for ACI was based on the American Container Security Initiative (CSI) that created preclearance rules. With the CSI effectively posting Customs officers at foreign ports around the world, Canada was under significant pressure to introduce a similar plan or face the reality that CBP officers would be placed in Canadian ports. As this would be a very visible loss of Canadian sovereignty, the CBSA quickly came up with the ACI plan. ACI includes the following rules, which are very similar to the rules of the CSI.

3. Implementation and Enforcement

(1) Phase 1: Marine Mode

Phase I of the Advance Commercial Information (ACI) Program was implemented on April 19, 2004, requiring marine carriers to electronically transmit marine cargo data to the CBSA 24 hours prior to cargo loading at a foreign port. This requirement allows the CBSA to effectively identify threats to Canada’s health, safety, and security prior to the arrival of cargo and conveyances in Canada.

(2) Phase 2: Air Mode and Marine Shipments Loaded in the United States

Implementation of Phase 2 of the ACI program was completed on July 26, 2006, requiring air carriers and freight forwarders, where applicable, to electronically transmit conveyance, cargo and supplementary cargo data to the CBSA four hours prior to arrival in Canada or, if the duration of the flight to Canada is less than four hours, before the aircraft’s time of departure.

As well, ACI Phase 2 also expanded marine requirements to include shipments loaded in the United States.

(3) What are the benefits of eManifest?

eManifest will require the electronic transmission of advance cargo and conveyance information from carriers for all highway and rail shipments. In addition, the electronic transmission of advance secondary data will be required with freight forwarders and the electronic transmission of advance importer data will be required by importers or their brokers. Let’s find out more about eManifest in the next section.

4. eManifest

(1) What is eManifest?

eManifest is a major transformative initiative that is modernizing and improving cross-border commercial processes. eManifest is the third phase of the Advance Commercial Information (ACI) initiative. ACI was introduced in the marine mode in 2004 and in the air mode in 2006.

When fully implemented, eManifest will require carriers, freight forwarders and importers in all modes of transportation (air, marine, highway and rail) to electronically transmit advance commercial information to the Canada Border Services Agency (CBSA) within the prescribed mode-specific time frames.

(2) Why do we need eManifest?

eManifest is part of the overall measure the Government of Canada is putting in place to enhance the safety, security and prosperity of Canadians and international trade while streamlining commercial cross-border processes.

Thousands of commercial shipments reach Canada’s border each day. By rigorously performing risk assessments on the advance data sent by the party who is in the best position to provide it, the CBSA is better able to assess the level of risk associated with each shipment.

(3) What are the benefits of eManifest?

The CBSA is committed to delivering a reliable, modernized and efficient commercial processing system that provides benefits to the trade community, the Government of Canada, and to Canadians.

eManifest will be a virtually paperless process that starts before shipments reach the border and enables low-risk, legitimate trade to cross the border more efficiently.

The transmission and notification systems being implemented under eManifest are improving two-way communication between businesses and with the CBSA. Businesses will also have the ability to receive all notices on the status and disposition of their shipments as they move through the commercial process, via Electronic Data Interchange (EDI) or the eManifest Portal.

eManifest is harmonizing information requirements to the greatest extent possible with the World Customs Organization and the United States (U.S.) Customs and Border Protection to reduce the administrative burden on business.

Trusted trader programs such Customs Self Assessment (CSA) and Partners in Protection (PIP) will continue to exist with the implementation of eManifest, and will complement the systems and processes that will be put in place by eManifest.

(4) What has been accomplished to date?

eManifest accomplishments to date include:

●the deployment of electronic systems (EDI and eManifest Portal) for highway carriers to transmit advance cargo and conveyance data, in 2011;

●the deployment of EDI systems for rail carriers to transmit advance cargo and conveyance data, in 2012; and

●the deployment of EDI and eManifest Portal systems for freight forwarders in all modes of transportation to transmit advance house bill data, in 2013.

Voluntary compliance periods are currently in effect for highway and rail carriers as well as for freight forwarders.

For additional information on how you can prepare for ACI / eManifest, please leave a comment below or contact us here.

Japan AFR

1. AFR Regulation Basics

As of March 2014, vessel operators and NVOCCs are required to electronically submit to Japan Customs information on maritime container cargo to be loaded on a vessel intended for entry into a port in Japan. Paper filings are no longer accepted. In principle, these filings should be submitted no later than 24 hours before departure of the vessel from a port of loading. Unlike other global advance manifest regulations, however, the exact timing for AFR filings to Japan Customs depends on where the cargo originates and which Japanese port the freight is destined for. For more information and for a comprehensive matrix of anticipated cut-off times and country-of-origin submission, details can be accessed on the Japan Custom’s website at

http://www.customs.go.jp/english/summary/advance/annex02.pdf

While the vessel operator or NVOCC is the party responsible for the AFR filing, they must obtain the necessary data elements from the shippers in order to ensure compliance. As such, shippers are likely to receive requests for information on data elements from their vessel operators and/or NVOCCs. Shippers need to ensure that the appropriate data is provided in an accurate and timely manner to their logistics services provider.

2. Filing Exemptions

Filing is required for all maritime container cargo to be loaded on a foreign trading vessel intended for entry into a port in Japan. The only current exemptions include Break-bulk cargo, empty container shipments (SOC and COC), and maritime container cargo not to be discharged in Japan (Freight Remaining On Board; FROB).

3. Ocean AFR Data Elements

Japan’s Ocean AFR data elements are based on the WCO SAFE Framework and pull elements from both the ocean master and house bill of lading. There are requirements for detailed cargo descriptions, based on Harmonized System (HS) Code at the 6-digit level.

While more data elements are required, the quality of the information transmitted will also be of key importance. For example, in the ‘Description of Goods’ field, it is no longer acceptable to simply state that a shipment contains “‘apparel”’. Instead, the field must be populated with a more detailed description, such as “Women’s knitted shirts, 100% cotton.” Additionally, some fields may require further party and sourcing information. Under the new AFR rules, for example, a consignee’s full address, telephone number and country code are required. Japan Customs has stated that incomplete filings may not be accepted.

4. Penalties for Non-Compliance

Japan Customs has noted that “penal provisions could be applied” and that cargo may not be unloaded “without the permission of discharge by Customs.” In addition, the agency has stated that those who do not submit cargo information may be “liable to imprisonment with labor for up to a maximum period of one year or a fine not exceeding five hundred thousand yen.”

5. How to File

Submissions from foreign ocean AFR filers cannot be made directly to Japan Customs. All foreign filings need to be made through service providers authorized by Nippon Automated Cargo and Port Consolidated System, Inc. (NACCS Center). For the list of service providers for Japan Advance Filing Rules authorized by NACCS Center to connect directly to NACCS, please visit to the NACCS Center’s website at http://www.naccscenter.com/afr/lsp.html. This is because the filing system must be located in Japan. The NACCS Center is responsible for import/export processes and customs-clearance services in Japan. It serves as an intermediary or ‘hub’ between the trade and Japan Customs.

6. What You Need to Do…

The data which needs to be included in the transmission is as follows:

●Shipper’s full style name and address

●Consignee’s full style name and address (unless to order)

●Notify party’s full style name and address (incl. telephone if consignee is to order)

●Container number

●Seal number

●Number of packages

●Cargo gross weight

●UN dangerous goods code for shipments containing hazardous goods

●Cargo description and HS code at a minimum of 6 digits

7. Helpful Educational Links

(1) Japan Customs Link: http://www.customs.go.jp/english/summary/advance/index.htm

(2) NACCS Link: http://www.naccscenter.com/afr/

(3) CyberLogitec’s SmartLink: https://portal.e-smartlink.com

* About CyberLogitec

CyberLogitec, an authorized service provider for Japan Ocean AFR compliance, provides a variety of flexible options to meet the needs of filers that run the whole gamut in terms of size and level of technical sophistication. CyberLogitec offers user-friendly solutions named SmartLink that can be readily accessed via the web and enterprise-class solutions that are pre-integrated into the shipment management and/or global regulatory compliance platforms which their customers are already using ? making the process as seamless as possible. CyberLogitec can also help filers obtain a Reporter ID, a designation similar to a Standard Carrier Alpha Code (SCAC) in the United States. A Reporter ID is required to file a Japan Ocean AFR submission.

| * Appendix - Summary of AFR |

| Which shipments need to file? |

Containerized shipments by sea to Japan. (AFR is applied at the last foreign port where cargo is loaded on a vessel heading for a port in Japan.) |

| Purpose of filing |

Japan Customs will check shipment info before loading. If they consider a shipment is a threat, shipment will not be allowed to load onboard or unload to Japanese ports. |

| How to file? |

Transmit shipment details electronically to Japan Customs. |

| When to file? |

At least 72 hours before loading on board depending on each shipping lines. |

| What to file? |

1. AHR (procedure to register advance cargo info): all B/L info, full cargo descriptions, and HSCODES of the most valuable or heaviest item.

2. ATD (procedure to report departure date and time): only shipping lines are required to file this. |

| What happens if fail to file or file after the deadline? |

1. Japan Customs will issue SPD notice.

2. Shipper must pay penalties, and ask Japan Customs for permission to discharge cargo. Then, filing must still be done.

3. If 2 is not done or Japan Customs does not give permission to discharge cargo, cargo will not be unloaded to Japanese ports. Shippers must pay penalties and pay arising charges to ship the cargo back. |

| Can amend or delete manifest? |

1. Before ATD is transmitted by shipping lines: Yes, can amend/ delete with a fee.

2. After ATD is transmitted by shipping lines: can amend/ delete only when Japan Customs issues HLD (hold), DNL (do not load), or DNU (do not unload) notice. Shippers also need to pay amendment fee. |

| Who must file? |

Shipping lines and NVOCCs (shippers are not required to file but have to provide to us info for filing before deadline) |

EU ENS / EXS

1. Pre-Arrival / Pre-Departure Declarations including Security Data

(1) Pre-Arrival / Pre-Departure Declarations

All cargoes departing from or arriving to EU must file pre-arrival / pre-departure declarations in accordance with the amended EU customs law related to security, which stipulates that they electronically submit safety and security data to the customs.

i. Cargo imported to EU customss

●Pre-arrival declaration must be electronically submitted within the time limit specified in the Customs Code, in either a) Entry Summary Declaration (ENS) that is electronically submitted to the member country’s system or b) Import Customs Declaration that includes security data sent to the customs declaration system of the relevant member country.

ii. Cargo exported out of EU customss

●Pre-departure declaration must be electronically submitted within the time limit specified in the Customs Code, in either a) Export Customs Declaration that includes security data sent to the customs declaration system of the relevant member country or b) Exit Summary Declaration (EXS) that is electronically submitted to the member country’s system (applicable only in case Export Customs Declaration is not required for customs procedure).

iii. Transit goods going through EU customs

●Declaration of cargo coming into EU customs can be filed either a) by submitting Transit Customs Declaration that includes security data or b) by submitting Transit Customs Declaration that focuses on customs clearance and does not include security data or submitting ENS that focuses on security.

●Declaration of cargo going out of EU customs can be filed either a) as a responsible person (carrier) submits Transit Customs Declaration that includes security data, in case Export Customs Declaration or EXS has not been submitted before a specific cargo is set for customs clearance, or b) by submitting Transit Customs Declaration that focuses on customs clearance and does not include security data or submitting EXS that focuses on security.

(2) Specifics of security data and time of transmission

i. Specifics of data related to prior security

< Table 1: EXS and ENS requirements for sea, air, inland waterways, and other means>

| Name |

EXS |

ENS |

| Number of Items |

Y |

Y |

| Unique Consignment Reference Number |

X/Y |

X/Y |

| Transport Document Number |

X/Y |

X/Y |

| Consignor |

X/Y |

X/Y |

| Person lodging the Summary Declaration |

Y |

Y |

| Consignee |

X/Y |

X/Y |

| Carrier |

. |

Z |

| Notify Party |

. |

X/Y |

| Identity and Nationality of Active Means of Transport Crossing the Border |

. |

Z |

| Conveyance Reference Number |

. |

Z |

| First Place of Arrival Code |

. |

Z |

| Date and Time of Arrival at First Place of Arrival in Customs Territory |

. |

Z |

| Country(ies) of Routing Codes |

Y |

Y |

| Customs Office of Exit |

Y |

Y |

| Country(ies) of Routing Codes |

Y |

. |

| Location of Goods |

. |

Y |

| Place of Loading |

. |

X/Y |

| Place of Unloading Code |

. |

X/Y |

| Goods Description |

X |

X |

| Type of Packages (Code) |

X |

X |

| Number of Packages |

X |

X |

| Shipping Marks |

X/Y |

X/Y |

| Equipment Identification Number, If Containerized |

X/Y |

X/Y |

| Goods Item Number |

X |

X |

| Commodity Code |

X |

X |

| Gross Mass (kg) |

X/Y |

X/Y |

| UN Dangerous Goods Code |

X |

X |

| Seal Number |

X/Y |

X/Y |

| Transport Charges Method of Payment Code |

X/Y |

X/Y |

| Declaration Date |

Y |

Y |

| Signature / Authentication |

Y |

Y |

| Other Specific Circumstance Indicator |

Y |

Y |

* X: Declaration Item of Goods Level

* Y: Declaration Header Level

* Z: Conveyance Report Level

* Combination of X, Y, and Z: pre-arrival / pre-departure information is provided at all levels indicated by X, Y, and Z.

ii. Submission time for different means of transportation

< Table 2: Security data submission time for different means of transportation>

| Origin & destination of transport, distance of transportation, and type of cargo |

Import |

Export |

| Maritime transport |

Container cargo (excluding short-distance maritime container cargo) |

24 hours before shipment from each foreign port |

24 hours before shipment of cargo to be transported out of EU |

| Bulk / Break bulk cargo (short-distance maritime bulk / break bulk cargo excluded) |

4 hours before arrival to the first EU port |

4 hours before departure from an EU port |

| Short-distance maritime transport |

2 hours before arrival to the first EU port |

2 hours before departure from an EU port |

| Air transport |

Short-distance air transport (less than 4 hours) |

Before the actual take-off of the aircraft |

30 minutes before the take-off of the aircraft |

| Long-distance air transport (4 hours or longer) |

4 hours before arrival to the first EU airport |

30 minutes before the take-off of the aircraft |

| Rail transport |

2 hours before arrival to the EU customs office of first entry |

2 hours before departure from the customs office of first entry |

| Inland waterway transport |

2 hours before arrival to the EU customs office of first entry |

2 hours before departure from the customs office of first entry |

| Road transport |

1 hour before arrival to the EU customs office of first entry |

1 hour before departure from the customs office of first entry |

*) Short-distance maritime transport

1) Transport from an origin to a destination in the EU customs jurisdiction excluding Greenland, Faroe islands, Ceuta, Melilla, Norway, Iceland, Baltic Sea ports, North Sea ports, Black Sea ports, Mediterranean Sea ports, French overseas departments, Azores, Madeira, and Canary islands.

2) Transport shorter than 24 hours from an origin outside the EU tariff jurisdiction and a destination in French overseas departments, Azores, Madeira, and Canary Islands.

Next, we will take a closer look at the entry summary declaration (ENS) regarding goods coming into EU.

2. Entry Summary Declaration (ENS) regarding goods imported to EU

(1) The purpose of lodging the ENS

The pre-arrival information on all goods coming into EU must be sent to the customs in the form of ENS before the cargo arrives to EU. The purpose of lodging the ENS is to carry out an effective risk assessment before cargo arrival and guarantee that there is no delay in the logistics network. In other words, as cargo that has been confirmed through a prior risk assessment to include no hazards is going to be promptly processed on its arrival, it contributes to smooth logistics.

(2) Time to lodge the ENS

The ENS must be electronically submitted within the deadlines as shown on Table 2. Basically, it is to be submitted to the customs office of first entry, that is, the first port of call within EU tariff jurisdiction. If electronic connection is not available with the customs office of first entry, however, one may submit the ENS to some other customs office. Still, the customs office of first entry shall be responsible for assessing the risks of the arriving cargo.

(3) Eligible ENS lodger

The operator of the means of transportation that delivers goods into the EU tariff jurisdiction is responsible for lodging the ENS. The operator (or carrier) is the person who moves goods into the EU tariff jurisdiction or is responsible for carrying cargoes. Someone else may replace a carrier in lodging the ENS, but this doesn’t exempt the carrier from responsibility. So, the ENS can be lodged by some other person than the carrier, only with the carrier’s acknowledgement and agreement.

(4) Goods eligible for ENS

As for goods that are eligible to be included in the ENS, the general principle of EU legislation stipulates that all goods coming into the EU tariff jurisdiction must be included in the ENS regardless of their destination. This means that all cargoes must be declared, whether they are sent to EU or they are Freight Remaining on Board (FORB).

i. Items not eligible for declaration

●Personal stuffs: travel bags, letters, postcards etc.

●Military materials and equipment: weapons and other military equipment used in national defense.

●Energy: if imported through electric cables (for electricity) or pipeline (for natural gas).

●Others: Goods through ATA3 Carnet and CPD Carnet, and goods exempt from declaration in accordance with Vienna Convention on Diplomatic Relations (Vienna, 18 April 1961) and Convention on Special Missions (New York, 8 December 1969).

ii. Unit used for lodging the ENS

In lodging the ENS, maritime carriers are to choose the unit, but most companies as WSC members adhere to the method of lodging a single ENS for each bill of lading.

(5) Data modification after the ENS is lodged

An ENS must be complete and accurate. But, sometimes one has to modify data after the ENS has been sent out. In this regard, Customs Act has no special limitation, but one is not allowed to modify such items as ENS lodger, agent, and the customs office of first entry for technical reasons.

As ENS serves as the basis for risk assessment, all modifications are accompanied by related risk assessment. In case modification is done just before cargo arrival, the competent customs authority should need extra time for risk assessment, which would affect the checkout of the cargo

However, submitted ENS cannot be modified in the following cases.

i. The lodger of the first ENS has been notified by the customs office of first entry that it will inspect the cargo.

ii. The customs authority finds out that the specific item is wrong.

iii. As the cargo is shown, the customs office of first entry has authorized the removal of the cargo.

iv. Route change notice has been recognized by the customs office of first entry.

(6) Risk analysis and action by the customs and penalties for failed lodging

The customs office of first entry that receives the ENS carries out a risk assessment based on it. Actions in accordance with the risk assessment are divided into maritime container cargo and others.

i. Container shipment (excluding short-distance transport).

About an ENS that is lodged 24 hours before shipment, a risk assessment is carried out, and if a very grave security risk is reported, a ‘Do Not Load (DNL)’ message is issued to the declarer.

ii. Bulk / break bulk cargo that should submit ENS 4 hours before arrival to the first EU port of entry and short-distance maritime transport cargo with a deadline set 2 hours before arrival.

A risk assessment must be carried out before a ship’s arrival, and if risks are confirmed, the competent customs authority will intervene immediately in proportion to the involved risks. While it is not mandatory, the customs will notify the carrier whether the authority wants to inspect suspicious cargo at the port of first entry, or as an alternative, at the port of discharge.

3. Other required submissions

●Before or as soon as a ship arrives to the port of first entry, the ship operator must submit arrival notification to ensure that the customs authority can check all copies of ENS that have been submitted to the customs regarding the entire shipment. As before, the manifest too must be submitted for a container that needs to be loaded to the port of first entry.

●ENS is just for assessment of any risks involved in cargo, and, even if it should include the same information as the ENS, a manifest must be submitted as well and has to include extra data that is specified in transport laws of the EU member states that the specific ship arrives to.

4. Do you want to import or export goods or move them in transit?

For more information on How to Import / Export / Transit, please visit European Customs Information Portal:

●European Customs Information Portal

●European Customs Information Portal - Model Transactions

Korea KMS

1. Overviews

As advance cargo manifest filing became a global standard, the system was introduced on Mar. 28, 2011 to improve the Korean trade practices to be fitted to the global norm and upgrade advance import and export cargo risk management.

2. Enforcement and Responsibility

Shipping companies and airliners must strictly meet the deadlines for submitting a cargo manifest on arrival and departure of import and export cargo, and a cargo manifest must be filled out so that it matches the list of the actually loaded cargoes.

Sea Export Cargo: effective on Apr. 1, 2012

Air Import Cargo: effective on Jun. 1, 2012

A cargo manifest compiled and created by a shipping company or an airliner is to be submitted through an error-checking business operator to Korea Advance Manifest System (KMS).

A forwarder has the right to create and modify House B/L data.

3. Reporting and Deadlines

Submission deadlines vary with different modes of transport and between import and export.

| Division |

Submission deadline |

| Sea Export |

(Principle) At least 24 hours before commencement of loading(Short sea shipping) Prior to loading, 30 minutes before departure(Bulk, Transit cargo) Before departure(Goods for on-board export declaration) no later than 24 hours after the departure of a ship |

| Air Import |

(Principle) At least 4 hours before arrival(Short haul) Before departure at the airport of loading(Express Cargo) At least 1 hour before arrival |

The scope of short-haul-flight areas is limited to China, Taiwan, Hong Kong, Japan, and far-Eastern Russia. In case of export sea cargo, the Philippines, Vietnam, Cambodia, Thailand, Indonesia, Malaysia, and Singapore are also regarded as short-sea-shipping areas.

A manifest must include the following.

Exporter information Importer information Accurate description of goods Type of packaging Number of packages Container number, seal number (if applicable)Weight Export Good Permit Number (EPN)

For data elements to be included in a manifest and how to fill it out, refer to the “Manifest Implementation Guide” as set by the Commissioner of the Korea Customs Service. Ocean and air carriers must fill out a manifest while taking note of the entry name, definition, condition, and standard as specified in "Message Implementation Guide".

A manifest will be accepted by the Korean Advance Manifest System of the Korea Customs Service, only when it has been found without problems through error checking. A manifest that has been found with problems through error checking must have the errors addressed before it is submitted

4. Penalties for Noncompliance

Ocean and air carriers that fail to meet the deadline for submitting a manifest violates Article 276 (False Declaration), Section 3 of the relevant law, and is subject to a fine. Computer processing errors must be addressed by adding B/L and is subject to error point and a negligence penalty.

5. Reference Information

Korean Customs Service

http://www.customs.go.kr/kcshome/index.jsp

KMS Information

http://www.customs.go.kr/kcshome/cop/bbs/selectBoard.do?layoutMenuNo=21010&bbsId=BBSMSTR_1352&nttId=274

http://www.customs.go.kr/kcshome/cop/bbs/selectBoard.do?layoutMenuNo=15021&bbsId=BBSMSTR_1201&nttId=10